As we enter the new year, we highlight key IRS inflation-adjustment changes for 2024. Here is what you need to know:

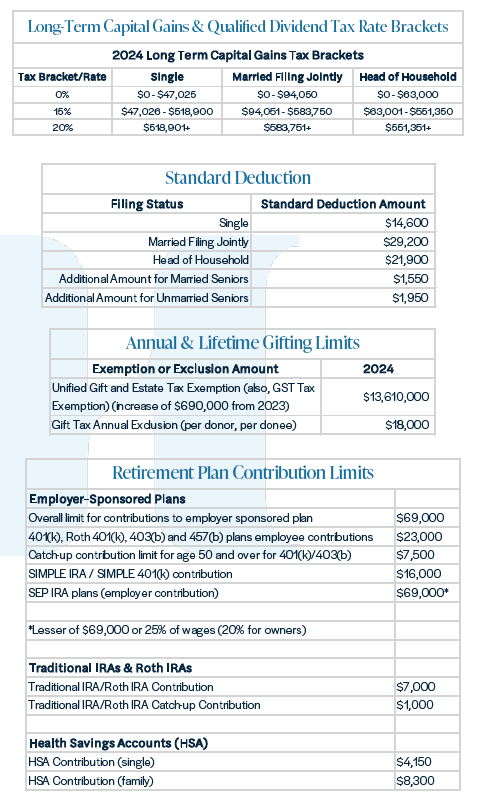

The IRS has released inflation adjustments for over 60 tax provisions for the 2024 tax year. One of the most notable changes is an increase in the tax brackets for individual filers. The brackets have been expanded to account for inflation. For example, the top threshold of the 24% bracket for married couples filing jointly rises from $383,900 to $403,900. The ceiling of the 35% bracket for these filers increases from $731,200 to $759,900. While the rate changes impact filers differently depending on their situation, the key takeaway is that the brackets are adjusted upward to counteract inflation. This means income that was taxed at a higher rate before may now fall into a lower bracket.

We are mindful that tax policy may change depending on the next administration. We will continue to monitor the policy picture in Washington as the election unfolds this year and will keep you informed of tax planning opportunities depending on individual client circumstances.

Other changes resulting from this adjustment are that the annual amount you can give without being liable for gift taxes is going up to $18,000 per person. The lifetime Unified Credit also bumped up to $13.61 million – or over $26 million for a couple. This amount will most likely revert to approximately half that amount in 2026. Finally, with state and local tax deductions still limited to $10,000, more of our clients are using the standard deduction, which is just under $30,000. Unless you have meaningful mortgage interest that can be itemized, it may make sense to “batch” your charitable giving to allow for itemizing one year and the standard deduction the next – please ask!