A harsh reality

Global equity market performance continued to deteriorate in the third quarter. U.S. equities, as measured by the S&P 500 Index, returned -4.9% in the quarter, including dividends. On a year-to-date basis, the stock market has declined nearly 23%. International stocks, as measured by MSCI’s All Country Worldwide Ex-U.S. benchmark, fared even worse. They declined nearly 10% in the third quarter including dividends, representing a 26% year-to-date decline.

Market drivers during the quarter

The reasons for continued stock market weakness remained the same as they were during the first half of 2022. As discussed above, stubbornly high inflation left the Federal Reserve – according to Chair Powell and his colleagues – with no choice but to continue aggressively raising short-term interest rates. Powell et al. aim to slow economic growth to the point of taming inflation, ideally without causing the U.S. to enter a recession. However, if a recession is the price of breaking the inflation

trend, it is one the Fed is willing to pay. Unfortunately, the inevitable slowing of economic growth, rising prospects of a recession, and sheer uncertainty facing our world on many fronts led investors to push stock prices to fresh, 2022 lows this past quarter.

A key problem with the Fed’s actions is that they take a long time to impact inflation, so we will not know for quite some time if the Fed has gone too far. By then, it could be too late to keep the economy out of a recession. For now, the Fed is stuck between persistently high inflation necessitating rate increases, and data (e.g. oil prices) that may indicate inflation will begin to slow its rise. When coupled with signs of financial market distress, there are concerns that the Fed is overcompensating for its initial, slow response to inflation. Beyond the United States, though integrally linked in many ways, three major factors hurt international stocks in the third quarter: Russia’s war on Ukraine, China’s weakening economy, and a strengthening U.S. dollar.

First, Russia’s ongoing war against Ukraine has cast a dark cloud over the entire world. We focus on financial markets and global economies in this newsletter, but the pain and suffering this senseless war has caused so many people, particularly the Ukrainians, is not lost on us. Russia’s war has exacerbated inflationary pressures across the world by further disrupting supply chains, causing food shortages, and triggering an energy crisis. As European countries anticipate the cold winter ahead – not to mention the potential for a further escalation in the fighting – the economic outlook is grim and investors are not exactly excited to own international stocks.

Second, China’s economy is weakening, sending shock waves well beyond its borders. COVID lockdowns, a falling property market, and other factors are stunting growth in the world’s second-largest economy. Thanks to globalization, China’s economic woes are being felt nearly everywhere else in the world. Increasing tensions with Taiwan are certainly not helping either, and the effect of this combination of factors is continued selling pressure on international equities.

Finally, with regard to global equity markets, more aggressive monetary policies (e.g. interest rate increases) by the Federal Reserve as compared to many other central banks are resulting in a strengthening U.S. dollar. Many countries purchase commodities – corn, soybeans, wheat, and oil to name a few – in dollars. When the value of their currencies is dropping and their costs are rising, the result is even more pressure on economic growth and inflation throughout the world.

In summary, as we have discussed in prior communications, global stock prices tend to follow earnings expectations. Inflation, rising interest rates, geopolitical chaos, supply chain issues, and foreign currency volatility present material headwinds to earnings growth and hence stock market performance.

Outlook

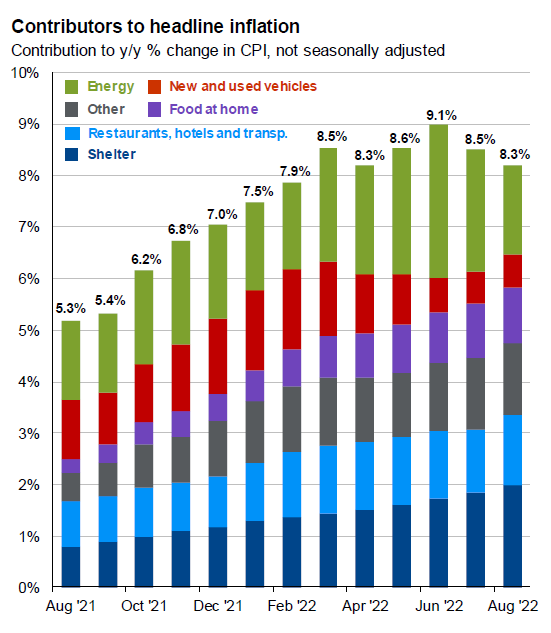

As we look to the fourth quarter of 2022 and into 2023, we do not see a quick fix for any of the aforementioned issues. While it appears inflation in the US may have peaked (see chart ),

it remains stubbornly high in absolute terms and the Fed’s aggressive stance remains intact. Economic growth is slowing, but the extent of the deceleration (or perhaps decline) is impossible to know for sure. The Russia situation remains dire, and while the long-term outlook for China’s economy is strong, there is no telling how long it will take them to right the ship.

Stock prices are leading indicators of what is to come, as they tend to go down as the economy approaches a recession but before signs of weakness show up in the data. Conversely, stocks tend to go up during recessions – before signs of improvement show up in the data – as the market anticipates the recovery. As such, we will not know how bad things will get until stocks have already bottomed and started to recover!

However, that is not stopping us from determining how much current economic dynamics will affect corporate profits, and how much of this weakness is already priced into stocks given the S&P 500 Index’s 23% year-to-date decline. Corporate profits are clearly under pressure, but as of now the outlook still isn’t bad. For context, S&P 500 Index earnings per share (EPS) was $206 in 2021. Current estimates call for $222/$240/$260 in 2022/2023/2024. That represents solid growth from here, and if those numbers prove true, we see far more upside potential versus downside risk for stocks from current levels.

That said, the above estimates have fallen ~5% over the last few months and further estimate reductions are widely expected. As we consider a range of pessimistic scenarios moving forward, it is tough to imagine S&P 500 EPS falling below $175-200, or 10-20% downside from current levels, barring any major additional global shocks.

In the event earnings were to fall that much, at today’s S&P 500 Index 3700 level, that would put valuation at ~18-21x bear case EPS, or roughly in line with the market’s 25-year average valuation. From this perspective, we believe the market is already discounting material economic weakness in the near-term, but even in a bearish scenario for earnings, we think the market is looking increasingly attractive below 3700 on the S&P 500. With the environment so dynamic and uncertainties abundant, we are in no rush to double down, but our clients should not be surprised to see us add to attractively priced stocks and funds at or below current levels in light of our long-term outlook for equities.

Speaking of our long-term outlook for stocks, it remains unchanged. We are very much committed to this asset class because we see significant long-term capital appreciation potential underpinned by long-term economic growth in the United States. We also remain committed to international stocks, notwithstanding the current chaos overseas, because we continue to expect significant, long-term global economic growth and international stock valuations are very compelling at today’s levels. If history is a guide, stock markets recover 100% of the time. In many ways, our world is sailing through uncharted waters, but in terms of the market’s ability to recover and exceed prior highs, this time is not different.

We continually encourage our clients to communicate cash needs to us so we can plan accordingly and, if possible, avoid selling stocks on weakness. These efforts are particularly important in today’s environment.