Economic & Market Commentary

Insights

Read the latest news and guidance from Howland Capital.

All Insights

Company News

Diversity, Equity, and Inclusion

Economic & Market Commentary

Financial Wellness for Women

Giving Back

Planning & Guidance

Podcasts

Taxing Matters

Economic & Market Commentary

Equities Q1 2024

Economic & Market Commentary

Economy Q1 2024

Company News

Howland Capital Firm Update 2024

Planning & Guidance

Preparing for Tax Season: Essential Tips and Tricks

Planning & Guidance

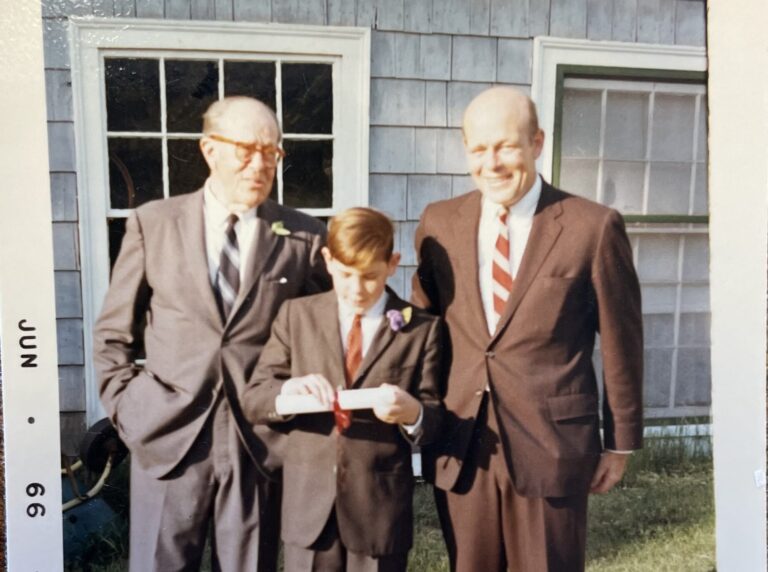

Generational Wealth: 4 Tips for Success During the Great Wealth Transfer

Taxing Matters

Understanding the 2024 IRS Inflation Adjustments: What You Should Know

Economic & Market Commentary

Equities Q4 2023

Economic & Market Commentary

Fixed Income Q4 2023

Economic & Market Commentary

Economy Q4 2023

Planning & Guidance

What Happens to Your 401(k) After Leaving Your Job?

Giving Back

Howland Capital & Cradles to Crayons Combat Clothing Insecurity

Up Next

Our Approach