Charitable giving has the potential to drive meaningful change, foster strong communities and generate social impact. As the world witnesses a massive generational shift in wealth, known as the “Great Wealth Transfer,” this potential feels more catalytic than ever. Over the next 25 years, trillions of dollars are expected to pass into the hands of younger generations, particularly millennials and Gen Z, profoundly transforming the landscape of philanthropy.

Younger donors often enter this scene with a distinct focus on purpose, values, and measurable results. Their approach tends to focus on creating deep connections with the causes they support and leveraging modern tools to maximize impact. No matter if you’re part of this emerging generation or reexamining your approach to giving, adopting thoughtful and strategic philanthropic practices can increase the likelihood that every dollar you contribute makes the maximum impact.

1. Modern Philanthropic Approaches for Younger Generations

Millennials and Gen Z are breathing new life into the philanthropic world, introducing innovative ways to approach giving. Unlike traditional methods that emphasize one-time, transactional donations, these generations are opting for lasting relationships with the social issues important to them. A 2021 report by Fidelity revealed that 74% of millennials view themselves as philanthropists, with 66% of millennial donors tracking results for the nonprofits they support. These figures compared to Baby Boomers at 35% and 32% respectively.**

Technology and social media play central roles. These platforms make nonprofit research more accessible and allow donors to engage directly with organizations through stories, videos, and live updates. Social media campaigns like “Giving Tuesday” highlight how digital spaces encourage collective action, with millions pooling their efforts toward shared goals.

Younger donors also value creating meaningful engagement with organizations over simple donations. Volunteering as well as providing financial support or even joining nonprofit advisory boards are increasingly popular. These approaches allow donors to help make a difference beyond financial contributions with their time, skills, and insight.

2. Why Having a Plan is Essential

Charitable giving, when approached strategically, has the power to achieve measurable results. Without a plan or clear vision, starting your journey can seem daunting.

A well-defined philanthropic strategy helps align your giving with your personal values and financial goals. Instead of focusing on quantity, prioritizing a few deeply meaningful causes can allow you to amplify your impact. For example, a family passionate about education might fund scholarships, support local schools, and volunteer within mentoring programs rather than giving small donations to multiple educational nonprofits. By concentrating resources, a donor’s efforts can create clearer, more measurable outcomes.

Additionally, strategically planned philanthropy helps your contributions not only align with your values but also your long-term financial objectives. Impact-focused giving might include tools like charitable trusts, donor-advised funds (DAFs), or investment portfolios with environmental, social, and governance (ESG) goals built in. Some families even integrate philanthropy into their financial legacy, creating multi-generational traditions of giving that carry on for decades.

3. Aligning Giving with Personal Values

The first step toward creating impactful philanthropy is self-reflection. What issues spark your passion? Where do you want to align your resources to make an impact? Identifying causes that resonate deeply with you or your family can lead to more purposeful and fulfilling contributions.

To begin, consider having discussions with family members or conducting self-assessments to uncover shared interests and priorities. Once you’ve identified key causes, thoroughly vet organizations to confirm accountability, transparency, and alignment with your goals. Look for nonprofits with proven track records, measurable outcomes, and values that mirror your own.

4. Taking the First Step

For those just beginning their philanthropic journeys, the process can feel overwhelming. But starting small is key. Even modest contributions have the power to create ripples of positive change when approached with intention.

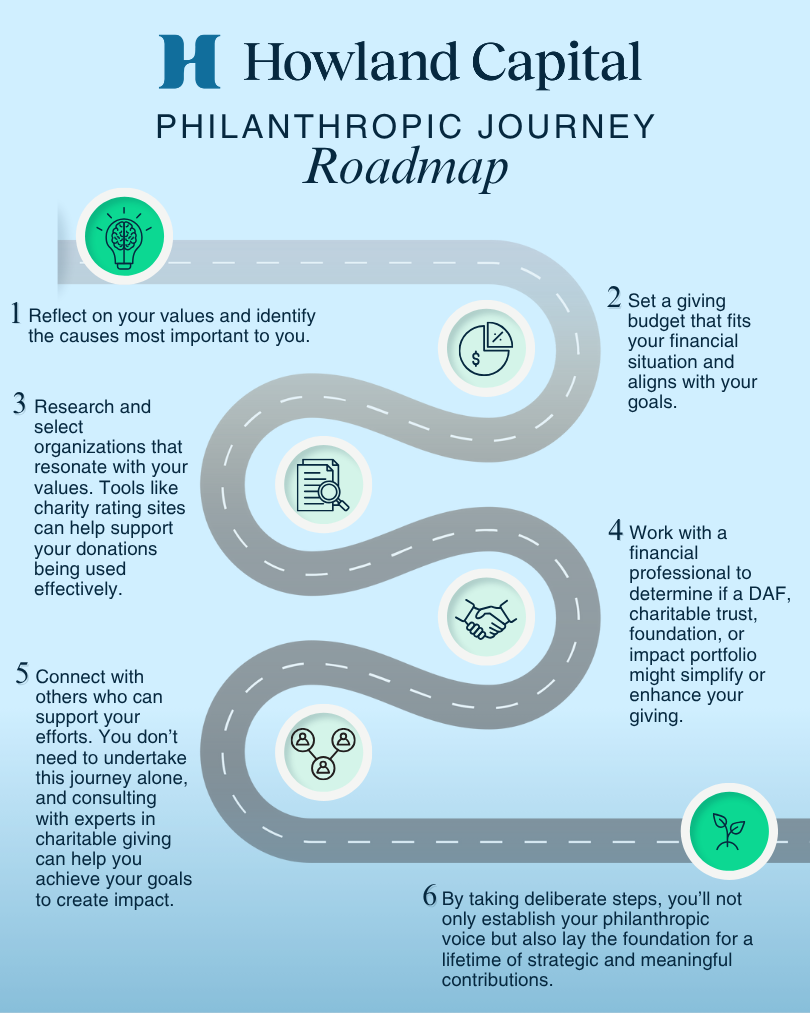

Here’s a simple roadmap to get you going:

-

-

- Reflect on your values and identify the causes most important to you.

- Set a giving budget that fits your financial situation and aligns with your goals.

- Research and select organizations that resonate with your values. Tools like charity rating sites can help you vet effective organizations.

- Work with a financial professional to determine if a donor-advised fund (DAF), charitable trust, foundation, or dedicated portfolio might simplify or enhance your giving.

- Connect with others who can support your efforts. You don’t need to undertake this journey alone, and consulting with experts in charitable giving can help you achieve your goals to create impact.

- By taking deliberate steps, you’ll not only establish your philanthropic voice but also lay the foundation for a lifetime of strategic and meaningful contributions.

-

Charitable giving goes beyond transactions; it’s a means of positively impacting lives and communities while staying true to your personal values. By carefully planning and adopting a strategic, value-driven approach, you can amplify the impact of every dollar you give, supporting enduring positive change in society.

Take the first step in your giving journey today. Whether your contribution is large or small, it matters. By staying mindful, organized, and intentional, you hold the power to make the world a better place for generations to come.

**https://www.fidelitycharitable.org/content/dam/fc-public/docs/resources/2021-future-of-philanthropy-summary.pdf