Investing in your 20s is an excellent way to prepare for a secure financial future. Starting early gives you time to take advantage of “the power of compounding,” which enables your wealth to build at an accelerating rate. You’ll also have the benefit of time to diversify your investments, which can help you manage risk. Investing in your 20s also gives you the opportunity to save for short-term and long-term goals, like buying a home or saving for retirement. Finally, investing in your 20s can help you protect your financial future by allowing you to build a cushion to get you through any tough times that may arise.

Investing With Time on Your Side

Take advantage of compounding returns. Compound returns are best explained with an example of compound interest. Compound interest occurs when interest earned from some or all the investments in an account is added to the principal balance, and then the next interest period is calculated on the total of the principal plus the accumulated interest.

This means that interest is added to the principal and then the interest rate is applied to the newly increased principal. As a result, the amount of interest earned each period grows with each period, resulting in the principal amount growing exponentially over time. For example, if you have a principal amount of $1,000 and an interest rate of 5%, the first interest period will earn you $50. Once that interest is added to the principal, the next period will earn you $52.50, and so on. This is why it’s important to start saving early because the longer you save, the more your principal balance will grow, even if the percentage rate of growth stays the same. 5% of $1,000 is $50, but 5% of $1,000,000 is $50,000!

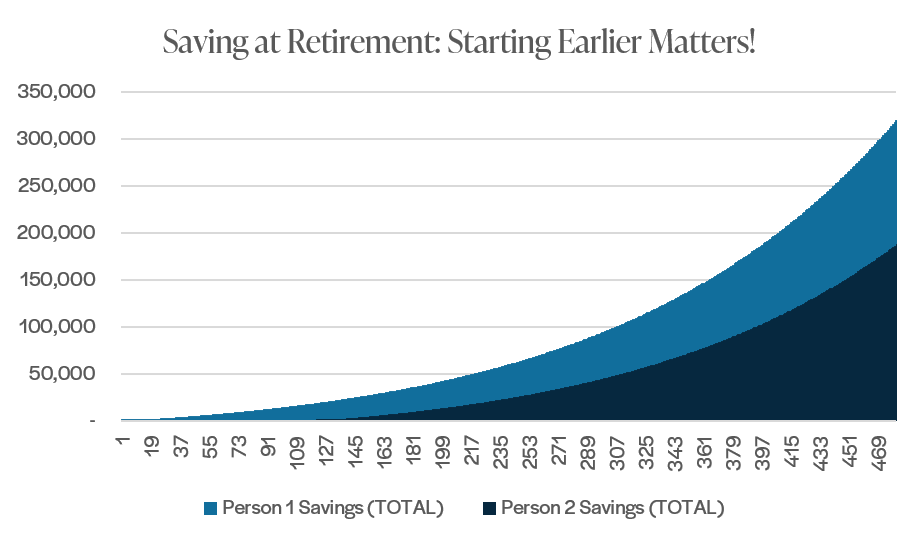

Below is a visual representation of the power of compounding: These two scenarios look at how much you will have saved at retirement (age 65 for example) if you start saving $100 per month at 25 versus 35. The differences are massive.

| Current Age | Age savings begin | Retirement age | Cumulative Contributions | Savings at retirement | |

| Person 1 | 25 | 25 | 65 | $82,342 | $319,624 |

| Person 2 | 25 | 35 | 65 | $68,725 | $187,796 |

| Difference | $13,617 | $131,829 | |||

| Person 1 contributed $13,617 more and ended up with $131,829 more at retirement! | |||||

Investing Through Your Employer

- Check to see if your employer offers a 401(k) or 403(b) plan. A 401(k) or 403(b) is a retirement savings plan that is sponsored by an employer. They allow employees to save and invest a portion of their paycheck before taxes are taken out. Maximize pre-tax 401(k) or 403(b) contributions as much as possible before receiving your first paycheck. Then set your budget based on your take-home pay. You won’t know you are missing the money if you don’t ever have it to begin with; meanwhile, you are making an investment every time you get paid.

- Your employer may also match a certain percentage of your 401(k) or 403(b) contribution, up to a certain amount. For example, an employer may match 50% of the employee’s contributions up to 3% of their salary. An employer match is a great benefit for you, as it allows you to save for your retirement while receiving a free contribution from your employer. For example, if you put $1,000 into your 401k and the match is 50%, your employer gives you $500. That is a tremendous value proposition – free money!

- Take advantage of employer benefits. Look into the benefits offered by your employer and take advantage of any discounts or other savings opportunities.

Investing in Your Future

- Consider opening an IRA. An individual retirement account (IRA) is a great way to save for retirement if you don’t have access to an employer-sponsored plan.

- A traditional IRA is a tax-deferred investment account, meaning that you won’t pay taxes on your contributions until you withdraw them in retirement. If you are currently in a higher tax bracket than you think you will be in retirement, a traditional IRA may be the best choice. The contributions you make to a traditional IRA may be tax-deductible, depending on your income level and whether you have access to a retirement plan through your employer. One major drawback to the traditional IRA is that you are required to start minimum withdrawals once you reach an age specified by the IRS (currently 73 and rising to 75 in 2033) and will have to pay income taxes on those withdrawals. Traditional IRAs that hold retirement assets transferred from employer plans and other IRAs are often called “rollover” IRAs.

- A Roth IRA is an individual retirement account (IRA) that allows people to save for retirement and pay taxes on the contributions after they have been made. Contributions to a Roth IRA are not tax deductible, but earnings can be withdrawn tax-free in retirement. This makes a Roth IRA a great way to save for retirement, especially if you expect your tax rate to be higher when you retire than it is currently.

Investing in Your Peace of Mind

One way to invest in yourself now is by working towards building an emergency fund. You will have better peace of mind if you have enough savings for 6-24 months of expenses in cash in case of job loss or other unforeseen issues.

One way to do this is to automate your savings. Set up an automatic transfer from your checking account to your savings account. Explore high-yield savings accounts to receive the additional interest benefit on your savings.

Balancing Your Investments

Avoid debt as much as you possibly can. Buying a house or going to grad school might make sense but avoid building up credit card or other high-interest debt. For more about good debt vs. bad debt, click here. (link to debt article)

In conclusion, the time to start investing is now. What are your priorities? Learn more about our approach and expertise, and let’s start a conversation.